|

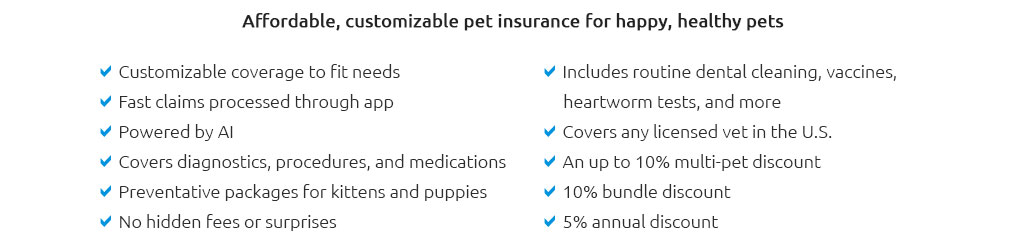

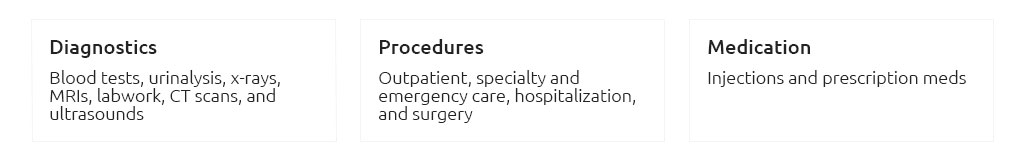

medical cat insurance for efficient, stable care at home and on the goYou want care that doesn't wobble your budget or your cat's routine. The right policy turns big, spiky vet costs into predictable, steady outflows so you can plan and move on. What it covers - and what it doesn't- Accidents and sudden injuries are core benefits.

- Illnesses like infections, GI issues, and many chronic diseases are commonly covered.

- Chronic and hereditary conditions are often included if first signs appear after enrollment and waiting periods.

- Diagnostics (x-rays, bloodwork, ultrasound) and prescription meds usually count.

- Dental illness is sometimes covered; dental cleanings are typically not unless you add wellness.

- Exclusions typically include pre-existing conditions, breeding costs, and experimental care.

- Waiting periods apply after you start - note separate windows for accidents, illnesses, and cruciate injuries.

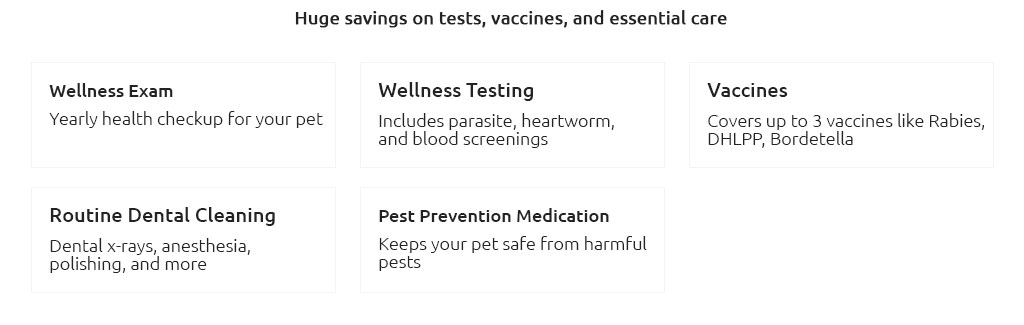

- Wellness add-ons can reimburse vaccines and checkups; they're convenience tools, not financial protection.

A quick real-life momentLast spring you opened the insurer's app after Luna started limping; a tele-vet triage pushed you to the urgent clinic, the visit hit $1,180, and your claim paid two days later - your rent stayed on track, your buffer stayed intact, and your evening stayed calm enough to feed the sourdough starter you keep forgetting about. Costs and levers you control- Monthly premium moves with your cat's age, breed risk, and location.

- Deductible higher deductible = lower premium; pick a number you can pay on any Tuesday.

- Reimbursement rate 70 - 90%. Higher rate smooths cash flow; lower rate trims cost.

- Annual limit sets ceiling. Higher limits stabilize against a bad year.

- Co-pay is the slice you always cover; simple equals reliable.

Claims math, fastExample: Invoice $2,000, deductible $250, reimbursement 80%, annual limit $10,000. Expected payout: ($2,000 − $250) × 0.8 = $1,400. Your share: $600 plus the deductible already counted, so cash planning stays clear. How to choose with efficiency and stability- List must-cover items for your cat's profile (e.g., urinary issues, asthma, orthopedics).

- Pull sample policies and scan exclusions and waiting periods first.

- Match reimbursement + deductible to your emergency fund, not to ideal-world you.

- Check claim turnaround data and app usability - time saved compounds.

- Favor lifetime, renewable coverage; avoid per-incident caps that reset awkwardly.

Stability signals- Financially strong underwriter and clear rate-change history.

- No lifetime condition limits; chronic care stays eligible each year.

- Direct pay to vets or quick e-payments reduce float stress.

- Transparent formulary and no surprise "reasonable and customary" clawbacks.

Common pitfalls- Waiting periods that outlast your cat's current limp or cough - start before you need it.

- Wellness add-ons purchased for savings that don't materialize; they're for structure, not profit.

- Low annual limits that look fine until imaging plus hospitalization arrives.

- Forgetting to submit records promptly; missing notes slow approvals.

Set yourself up for low-friction use- Schedule a baseline exam after enrollment so future claims have clean medical history.

- Store invoices and discharge notes in one folder; upload within 24 hours.

- Ask your vet to code the primary diagnosis clearly to avoid back-and-forth.

- Revisit limit and deductible at renewal if your cat's risk profile shifts or your savings grow.

- If you travel, confirm coverage across states and emergency hospitals; smooth access keeps weekends unspectacular.

You're aiming for a calm, repeatable system: predictable premiums, quick claims, steady care - room to adjust as your routine evolves.

|

|